Investing in the stock market has become increasingly accessible and convenient with the rise of online stockbrokers. These platforms provide investors with the tools and resources to trade stocks, manage portfolios, and make informed investment decisions from the comfort of their own homes. As we enter 2023, let’s take a closer look at the best online stockbrokers that are revolutionizing the way people invest.

Best Online Stockbrokers of 2023

- Best Overall:

- Best for Beginners and Mobile:

- Best Broker for Options:

- Best Broker for Advanced Traders and International Trading: Interactive Brokers

- Best Broker for ETFs:

BEST OVERALL

Fidelity

- Minimum Deposit: $0

- Fees: None for stocks, ETFs, and mutual funds, 65 cents per contract for options

- Account Types: Standard, retirement, education, trusts, managed portfolios, margin trading

Why We Chose It

Fidelity Investments, a giant in the financial industry, has been a trusted name for investors seeking a comprehensive online stockbroker. With a history spanning back to 1946, Fidelity has established itself as a reliable and reputable choice for individuals, institutions, and financial advisors alike.

One of the key factors that sets Fidelity apart is its wide array of investment options. Investors can choose from a diverse range of products, including stocks, bonds, mutual funds, ETFs, options, and more. This enables investors to create portfolios that align with their unique investment goals and risk tolerance. Fidelity also offers socially responsible investing (SRI) options for those who wish to invest in companies that align with their personal values.

Fidelity’s trading tools are another standout feature. The Active Trader Pro platform is a powerful tool designed for active traders, offering real-time data, advanced charting capabilities, and customizable trading screens. This empowers traders to make informed decisions and execute their trading strategies with confidence. Fidelity also offers a variety of order types, providing flexibility and versatility in executing trades.

Research and education are essential components of Fidelity’s offerings. The platform provides a wealth of research resources, including market insights, research reports, and analysis tools. Additionally, Fidelity offers educational materials such as webinars, tutorials, and articles to help investors stay informed about market trends and make well-informed investment decisions. Third-party research from reputable providers further enhances the platform’s offerings.

Fidelity’s retirement planning tools are also a significant draw for investors. With retirement calculators, educational materials, and retirement account options such as IRAs, 401(k)s, and 403(b)s, Fidelity equips investors with the tools they need to plan for a secure retirement. The platform also offers guidance and advice on various retirement planning strategies, including Social Security claiming and healthcare costs, helping investors make informed decisions for their long-term financial goals.

Furthermore, Fidelity’s mobile app provides convenience and flexibility for investors on the go. The user-friendly app allows investors to trade, track their investments, and access research and analysis tools from their mobile devices, making it easy to manage their portfolios anytime, anywhere.

Last but not least, Fidelity’s customer service is renowned for its excellence. A dedicated support team is available via phone, chat, or email to assist investors with their questions or concerns promptly and effectively, ensuring a positive customer experience.

Pros:

Investment Options: Fidelity offers a wide range of investment options, including stocks, bonds, mutual funds, ETFs, options, and more. This allows investors to build diversified portfolios and tailor their investments to their individual goals and risk tolerance.

Trading Tools: Fidelity’s trading platform provides advanced tools and features for active traders. The Active Trader Pro platform is designed for experienced traders and offers powerful trading tools, real-time data, and advanced charting capabilities. It also provides access to a large selection of research and analysis tools, helping traders make informed investment decisions.

Research and Education: Fidelity offers a wealth of research and educational resources to help investors make informed decisions. The platform provides market insights, webinars, tutorials, and other educational materials to help investors understand the markets and make informed investment choices. This makes it a great choice for both beginners and experienced investors looking to expand their knowledge.

Mobile App: Fidelity’s mobile app is user-friendly and provides a seamless experience for on-the-go trading and portfolio management. It allows investors to trade, track their investments, and access research and analysis tools from their mobile devices, providing convenience and flexibility for busy investors.

Retirement Planning Tools: Fidelity offers a range of retirement planning tools and resources, including retirement calculators, educational materials, and retirement account options such as IRAs and 401(k)s. This makes it a great choice for investors looking to plan for their long-term financial goals.

Cons:

- Fees: While Fidelity offers a wide range of investment options and powerful trading tools, some of these services may come with fees. For example, there may be commissions or fees associated with certain types of trades or investment products. It’s important for investors to carefully review and understand the fee structure before using Fidelity’s services.

- Account Minimums: Fidelity has a higher account minimum compared to some other online stockbrokers. While the minimum investment requirement may vary depending on the type of account and investment product, it may be higher than what some smaller investors are comfortable with.

- Complex Trading Tools: While Fidelity’s trading tools are powerful, they may also be complex and overwhelming for beginners or investors with limited trading experience. The Active Trader Pro platform, in particular, may require a steeper learning curve, making it more suitable for experienced traders.

BEST FOR BEGINNERS AND MOBILE

TD Ameritrade

- Minimum Deposit: $0

- Fees: None for stock, ETF, and mutual fund trades, 65 cents per contract for options

- Account Types: Standard, retirement, education, trusts, managed portfolios, margin

Why We Chose It

TD Ameritrade, a well-known name in the world of online stockbrokers, has gained a reputation for its extensive offerings and user-friendly platform. With a history dating back to 1971, TD Ameritrade has established itself as a reliable and popular choice for investors of all levels of experience.

One of the key reasons why investors choose TD Ameritrade is its wide range of investment options. From stocks and bonds to mutual funds, ETFs, options, and more, TD Ameritrade provides a comprehensive suite of investment products that cater to various investment strategies and goals. Additionally, TD Ameritrade offers a selection of commission-free ETFs, making it cost-effective for investors who want to minimize trading costs.

TD Ameritrade’s trading tools are another notable feature. The thinkorswim platform, designed for active traders, offers advanced charting capabilities, real-time data, and customizable trading screens, empowering traders to analyze markets and execute their trading strategies with precision. TD Ameritrade also offers a range of order types, including market orders, limit orders, stop orders, and more, giving traders flexibility in managing their trades.

Research and education are also strong points of TD Ameritrade. The platform provides a wealth of research resources, including market analysis, research reports, and news updates, helping investors stay informed about market trends and make informed investment decisions. TD Ameritrade also offers educational materials, webinars, and interactive tools to help investors learn and improve their investing knowledge and skills.

In addition, TD Ameritrade offers a robust retirement planning offering, including retirement calculators, educational materials, and retirement account options such as IRAs, 401(k)s, and 403(b)s. These tools help investors plan for their long-term financial goals and make informed decisions about their retirement savings.

TD Ameritrade’s mobile app is another highlight of its offerings. The app provides investors with the convenience and flexibility to manage their portfolios on the go, with features such as mobile trading, account monitoring, and access to research and analysis tools, making it easy to stay connected and manage investments from anywhere.

Furthermore, TD Ameritrade’s customer service is known for its responsive and helpful support. The platform offers 24/7 customer service via phone, chat, or email, with knowledgeable representatives ready to assist investors with their inquiries or concerns.

Pros:

Wide range of investment options: TD Ameritrade offers a comprehensive suite of investment products, including stocks, bonds, mutual funds, ETFs, options, and more. This allows investors to diversify their portfolios and implement various investment strategies.

Powerful trading tools: TD Ameritrade’s thinkorswim platform is known for its advanced charting capabilities, real-time data, and customizable trading screens, making it a preferred choice for active traders. The platform also offers a variety of order types, giving traders flexibility in managing their trades.

Research and education resources: TD Ameritrade provides a wealth of research resources, including market analysis, research reports, and news updates, helping investors stay informed about market trends. The platform also offers educational materials, webinars, and interactive tools to help investors learn and improve their investing knowledge and skills.

Retirement planning tools: TD Ameritrade offers retirement calculators, educational materials, and a range of retirement account options, helping investors plan for their long-term financial goals and make informed decisions about their retirement savings.

Mobile app convenience: TD Ameritrade’s mobile app allows investors to manage their portfolios on the go, with features such as mobile trading, account monitoring, and access to research and analysis tools. This provides investors with flexibility and convenience in managing their investments from anywhere.

Responsive customer service: TD Ameritrade offers 24/7 customer service via phone, chat, or email, with knowledgeable representatives ready to assist investors with their inquiries or concerns.

Cons:

Trading fees: While TD Ameritrade offers commission-free ETFs, it charges fees for other types of trades, such as stocks, options, and mutual funds. These fees can add up, especially for active traders or investors with high trading volumes.

Account minimums: TD Ameritrade requires a minimum initial deposit of $0 for a standard brokerage account, but some of its managed portfolio offerings may require higher minimums. This may be a deterrent for investors with limited funds to invest.

Platform complexity: TD Ameritrade’s thinkorswim platform, while powerful, may be overwhelming for novice investors or those who are not familiar with advanced trading tools. It may take some time to learn and navigate the platform effectively.

Limited international market access: TD Ameritrade’s focus is primarily on the U.S. markets, and its international market access may be limited compared to some other online stockbrokers. This may not be suitable for investors who are interested in trading or investing in international markets extensively.

No fractional shares: Unlike some other online stockbrokers, TD Ameritrade does not currently offer fractional share trading, which may be a drawback for investors who prefer to invest in smaller amounts or want to diversify their holdings with fractional shares.

BEST BROKER FOR OPTIONS

tastyworks

- Minimum Deposit: $0

- Fees: None for stocks or ETFs, $1 per options contract to open (max $10 per transaction) none to close, $1.25 per contract for futures, 1% for crypto ($10 max per transaction)

- Account Types: Standard, retirement, trust

Why We Chose it:

Tastyworks is an ideal stockbroker for day traders and active investors who primarily trade derivatives like options. Options are a popular tool among day traders as they provide opportunities to leverage portfolios and potentially earn significant returns (or losses) from small price movements in stocks.

One of the standout features of Tastyworks is its low-cost options trading. Unlike many other brokers that charge per-contract fees for options trades, Tastyworks sets a maximum fee of $10 for a single trade. This means that traders can enter or exit large positions without worrying about excessive fees eating into their potential returns.

Tastyworks not only excels in options trading but also offers the ability to buy and sell other securities like stocks and futures. Additionally, it has the option to invest in cryptocurrencies, making it a versatile choice for investors who seek multiple investment avenues and a broker that caters to active trading.

With its cost-effective options trading and diverse investment options, Tastyworks is a compelling choice for day traders and active investors who are looking for a broker that understands their unique needs and offers a wide range of trading opportunities while keeping costs low.

Pros:

Low Commissions: Tastyworks offers competitive and affordable pricing for options trading. They charge a flat fee of $1 per contract for opening and closing options trades, with no additional fees for exercise or assignment. This can be cost-effective for active options traders, especially compared to traditional brokerages that charge higher commissions.

Advanced Trading Tools: Tastyworks provides a robust suite of trading tools and features for experienced traders. Their platform is designed for active options traders and offers advanced charting, analytics, and customization options. They also have a proprietary trading platform called “tastyworks desktop” which offers a rich set of features for options trading.

Educational Resources: Tastyworks offers a wide range of educational resources to help traders improve their knowledge and skills. They provide free webinars, tutorials, and a comprehensive learning center with educational content on options trading strategies, technical analysis, and risk management. This can be valuable for beginner and intermediate traders looking to expand their understanding of options trading.

Efficient Trading Platform: Tastyworks is known for its fast and efficient trading platform, which is designed to provide quick order execution and minimal latency. This can be beneficial for active traders who require a reliable and responsive platform for their trading activities.

Cons:

Limited Investment Options: While Tastyworks specializes in options trading, it has limited investment options beyond options and equities. They do not offer mutual funds, bonds, or other investment products, which may be a drawback for investors looking for a more diversified investment portfolio.

Steeper Learning Curve: Tastyworks’ platform is tailored for experienced traders and may have a steeper learning curve for beginners. Novice traders may find the platform overwhelming with its advanced features and technical jargon, which may require additional time and effort to learn.

Inactivity Fees: Tastyworks charges inactivity fees for accounts that do not have any trading activity for 90 days. This can be a disadvantage for infrequent traders or investors who do not trade regularly, as it can result in additional fees that may eat into their returns.

Limited Customer Support: Tastyworks has limited customer support options compared to some other brokerages. They primarily offer support via email and chat, and do not have a dedicated phone support line. This may be a concern for traders who prefer to have immediate access to customer service via phone.

BEST BROKER FOR ADVANCED TRADERS AND INTERNATIONAL TRADING

Interactive Brokers

- Minimum Deposit: $0

- Fees: Varies – None to 0.005 cent per share

- Account Types: Standard, retirement

Why We Chose It

InteractiveBrokers is an ideal stockbroker for advanced traders due to its comprehensive tools and features. With support for over 100 different order types, it caters to the needs of experienced investors when opening or closing positions.

Moreover, InteractiveBrokers is a top choice for traders interested in international markets, as it operates in 150 markets across 33 countries and in 25 currencies. This allows for trading of stocks, bonds, futures, options, and currencies, all from a single account.

The broker also offers powerful trading and stock screening tools, making it a preferred option for advanced investors. Additionally, its transparent pricing structure, with a maximum commission of 1% per trade, is appreciated by those who seek clear and reasonable pricing.

Pros:

Wide Range of Markets: InteractiveBrokers offers access to a vast range of markets worldwide, including stocks, bonds, futures, options, and currencies. This makes it an attractive option for traders who are interested in diverse investment opportunities and global market access.

Advanced Trading Tools: InteractiveBrokers provides a robust suite of trading tools and features for advanced traders. Their trading platform offers sophisticated charting, analytics, and order types, catering to the needs of experienced investors who require advanced trading capabilities.

Transparent Pricing: InteractiveBrokers has a transparent pricing structure, with competitive commissions and fees. They offer low-cost trading, and their maximum commission per trade is 1% of the trade value, which can be cost-effective for active traders and investors.

International Trading Expertise: InteractiveBrokers is known for its expertise in international trading, with a wide presence in 150 markets across 33 countries. This can be advantageous for traders who are interested in trading in international markets and need access to diverse investment opportunities.

Customization and Flexibility: InteractiveBrokers offers a high level of customization and flexibility in terms of trading options, order types, and account configurations. This allows traders to tailor their trading strategies and investment approach to their specific needs and preferences.

Cons:

Steeper Learning Curve: InteractiveBrokers’ trading platform and tools may have a steeper learning curve, particularly for novice or less experienced traders. The platform can be complex and overwhelming for beginners, and may require time and effort to fully understand and utilize effectively.

Inactivity Fees: InteractiveBrokers charges inactivity fees for accounts that do not meet certain trading activity requirements, which may be a drawback for infrequent traders or investors who do not trade regularly. These fees can add up and impact overall returns.

Minimum Balance Requirements: InteractiveBrokers has minimum balance requirements for different types of accounts, which may be a limitation for investors with smaller account balances. Maintaining the required minimum balance may be challenging for some traders or investors.

Customer Service: While InteractiveBrokers offers customer support, some users have reported that their customer service response times may not always be prompt or satisfactory. This may be a concern for traders who require timely and efficient customer support.

Platform Complexity: The advanced features and customization options offered by InteractiveBrokers may also be overwhelming for some users, leading to a steeper learning curve and potential difficulties in navigating the platform effectively.

BEST BROKER FOR ETFS

Charles Schwab

- Minimum Deposit: $0

- Fees: None

- Account Types: Traditional brokerage, retirement, trust, robo-advisor, 529 plans

Why We It

As one of the largest brokers in the market, Charles Schwab stands out as our top pick for the best broker for ETFs. With over 25 ETFs managed by Schwab and some of the lowest expense ratios in the industry, it offers a cost-effective option for investors.

One of the key advantages of Schwab is its commission-free trading for ETFs, allowing investors to trade ETFs from other brokers without incurring additional fees. This flexibility gives investors the freedom to choose from a wide range of ETF options without worrying about added costs.

Beyond its brokerage account, Schwab also offers various account types for retirement savings or education planning, making it a convenient one-stop-shop for all your investment needs.

Schwab’s well-designed mobile app also allows investors to easily monitor their portfolio and execute trades while on the go, providing convenient access to their investments anytime, anywhere.

Pros:

Extensive ETF Offerings: Charles Schwab offers a wide range of ETFs, including over 25 ETFs that it manages, with some of the lowest expense ratios in the industry. This provides investors with a diverse selection of ETF options for their investment strategies.

Commission-Free ETF Trades: Schwab allows for commission-free trading of ETFs, including their own managed ETFs, as well as ETFs from other brokers. This can result in cost savings for investors, especially for frequent ETF traders.

Account Variety: Charles Schwab offers a variety of account types, including brokerage accounts, retirement accounts, and education savings accounts, providing investors with flexibility and convenience in managing their investments in one place.

User-Friendly Mobile App: Schwab’s mobile app is well-designed and user-friendly, allowing investors to easily monitor their portfolio, execute trades, and access account information on the go.

Established and Reliable Broker: Charles Schwab is one of the largest and most established brokers in the industry, with a long history of providing reliable brokerage services to investors. They have a strong reputation for customer service and investor support.

Cons:

Potentially Higher Expense Ratios for Non-Schwab ETFs: While Schwab offers low expense ratios for their managed ETFs, expense ratios for ETFs from other brokers may be higher, potentially impacting overall investment costs for investors who prefer non-Schwab ETFs.

Account Fees: Charles Schwab may charge certain fees for certain account types, such as annual maintenance fees or transaction fees for specific investment products, which may impact overall investment returns.

Potential for Account Minimums: Schwab may have minimum balance requirements for certain account types, which may be a limitation for investors with smaller account balances.

Limited Investment Offerings: While Schwab offers a diverse range of ETFs, their offerings for other investment products, such as individual stocks, bonds, or mutual funds, may be more limited compared to other brokers, which may not suit all types of investors.

Customer Service Response Times: Some users have reported that Schwab’s customer service response times may not always be prompt, which may be a concern for investors who require timely and efficient customer support.

In conclusion, online stockbrokers provide convenient ways to buy and sell investments, making investing an important part of preparing for the future. When choosing a stockbroker, it’s crucial to consider factors such as minimum balances and fees, as well as the unique tools offered by each broker that align with your investing style. By carefully evaluating these aspects, you can find the right stockbroker that meets your specific needs and helps you achieve your investment goals.

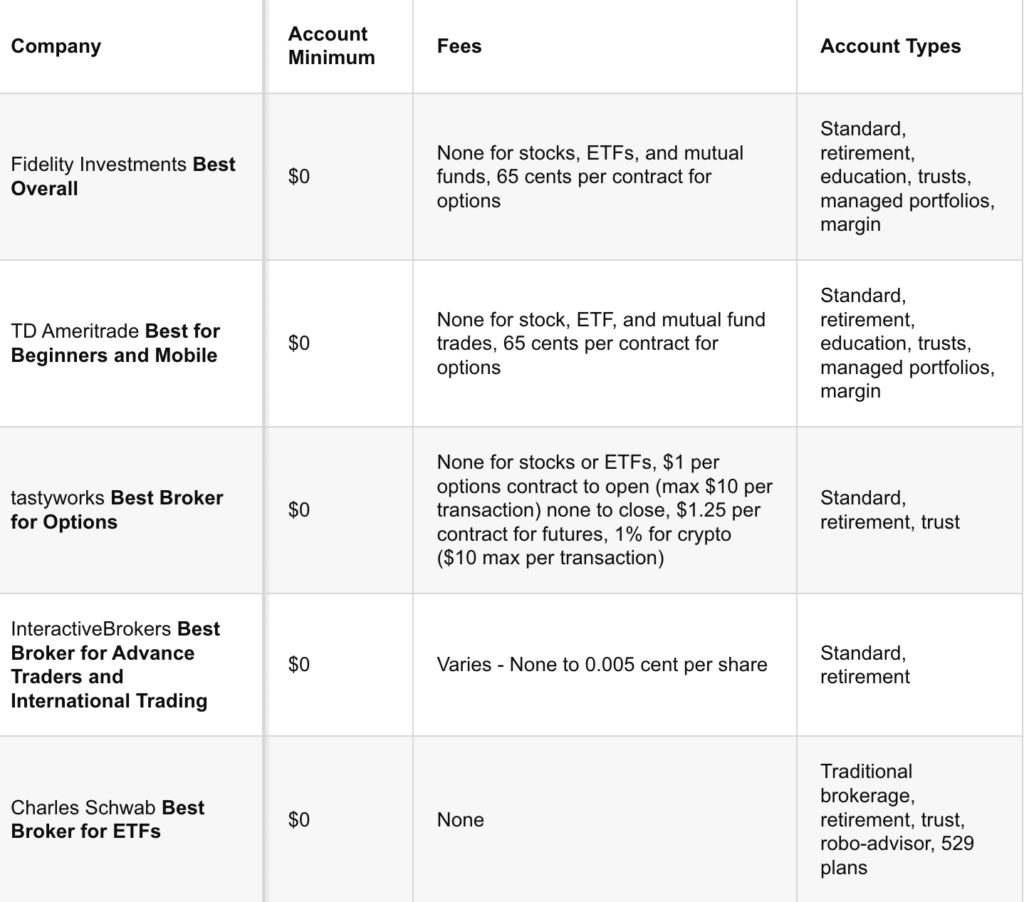

Compare the Best Online Stockbrokers

How Does an Online Stockbroker Work?

An online stockbroker is a financial institution or platform that facilitates buying and selling of securities, such as stocks, bonds, and other investment products, over the internet. It provides individuals with a user-friendly online platform that allows them to invest in the stock market from the comfort of their own homes or offices. Here’s a breakdown of how an online stockbroker works:

Account Creation: To start using an online stockbroker, investors typically need to create an account by providing personal and financial information. This may include details such as name, address, social security number, employment information, and bank account information.

Account Funding: Once the account is created, investors need to fund it by depositing money into the account. This can be done through various methods, such as bank transfers, wire transfers, or electronic payments.

Research and Trading Tools: Online stockbrokers provide investors with a variety of research and trading tools to help them make informed investment decisions. These tools may include real-time stock quotes, financial news, charting tools, and market analysis reports.

Placing Trades: Investors can use the online platform to place buy or sell orders for stocks or other securities. They can specify the quantity, price, and other parameters of the trade. The stockbroker then executes the trade on the investor’s behalf in the relevant stock exchange or market.

Order Execution: Once the trade is executed, the online stockbroker confirms the details of the trade, such as the price, quantity, and time of execution. The investor may receive a trade confirmation via email or other means.

Account Management: Online stockbrokers also provide tools for investors to manage their investment portfolios. This may include tracking the performance of investments, reviewing account balances, and accessing account statements and tax documents.

Fees and Charges: Online stockbrokers may charge fees for various services, such as account maintenance fees, trading commissions, and other transaction fees. It’s important for investors to understand and consider these fees when using an online stockbroker.

Safety and Security: Online stockbrokers employ various security measures to protect the privacy and security of investors’ personal and financial information. This may include encryption, multi-factor authentication, and other security protocols.

Customer Support: Online stockbrokers typically provide customer support through various channels, such as phone, email, and chat. Investors can seek assistance with account-related inquiries, trading issues, and other concerns.

How Much Money Do I Need To Use an Online Stockbroker?

The amount of money needed to use an online stockbroker can vary depending on the specific broker and the type of account you wish to open. Here are some general guidelines:

Many online stockbrokers require a minimum account balance to open an account. This can range from as low as $0 to several thousand dollars or more, depending on the broker. Some brokers may also waive the minimum account balance requirement for certain types of accounts or specific promotions.

Online stockbrokers may charge trading fees or commissions for each trade executed on your behalf. These fees can vary widely depending on the broker and the type of investment product being traded. Some brokers may offer commission-free trading for certain types of securities, such as stocks or ETFs, while others may charge fees for all trades.

It’s important to note that the amount of money needed to use an online stockbroker will depend on your investment goals and strategies. For example, if you plan to actively trade stocks or other securities, you may need a larger account balance to cover trading fees and maintain sufficient buying power. On the other hand, if you plan to invest in low-cost index funds or other long-term investment options, the minimum account balance and fees may be lower.

It’s recommended to carefully review the fees and requirements of different online stockbrokers before opening an account to ensure that you understand the costs associated with using their services. Additionally, it’s important to consider your own investment goals, risk tolerance, and financial situation when determining how much money you need to use an online stockbroker effectively.

How to Choose the Best Online Stockbroker

When selecting an online stockbroker, it’s important to consider the cost of the service, including account minimums, trade commissions, and other fees, as these can impact your overall investing performance. Additionally, evaluating the tools and features offered by the broker, such as stock screeners or research resources, can help inform your investment decisions.

Are Online Stockbrokers Safe to Use? Yes, online stockbrokers are generally safe to use. They employ industry-standard technology to safeguard your information and funds, and are insured by the Securities Investor Protection Corporation (SIPC), which provides coverage of up to $500,000 for your assets in case of financial issues with the broker.

Methodology

Our reviews and ratings of online brokers are unbiased and comprehensive, based on months of evaluating various aspects of their platforms, including user experience, trade executions, product offerings, costs and fees, security, mobile experience, and customer service. A rating scale is established using these criteria, with thousands of data points weighed into a scoring system.

Options Trading Risks

Options trading involves significant risks and may not be suitable for all investors. Certain complex options strategies carry additional risks. It’s important to read and understand the Characteristics and Risks of Standardized Options before trading options. Supporting documentation for any claims, if applicable, can be requested.